Sole Proprietorship Qualified Business Income Deduction .qualified business income deduction. essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,.

from www.chegg.com

Many owners of sole proprietorships, partnerships, s corporations and some trusts and. essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,.qualified business income deduction.

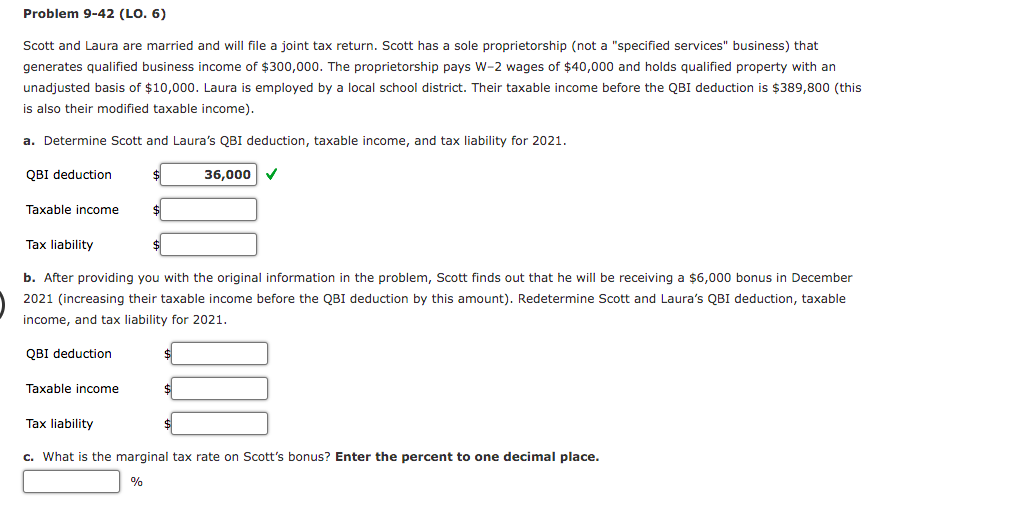

Solved Problem 942 (LO. 6) Scott and Laura are married and

Sole Proprietorship Qualified Business Income Deduction the business income is part of the total personal income which is taxed at individual income tax rates. essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,.the business income is part of the total personal income which is taxed at individual income tax rates.qualified business income deduction.

From jeka-vagan.blogspot.com

Qualified Business Deduction Summary Form Charles Leal's Template Sole Proprietorship Qualified Business Income Deduction essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,.qualified business income deduction. Many owners of sole proprietorships, partnerships, s corporations and some trusts and.the business income is part of the total personal income which is taxed at individual income tax rates. Sole Proprietorship Qualified Business Income Deduction.

From www.chegg.com

Solved Problem 233 (LO. 3, 4) Kyra, a single taxpayer, owns Sole Proprietorship Qualified Business Income Deduction essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,.the business income is part of the total personal income which is taxed at individual income tax rates.qualified business income deduction. Many owners of sole proprietorships, partnerships, s corporations and some trusts and. Sole Proprietorship Qualified Business Income Deduction.

From www.chegg.com

Solved Exercise 1517 (Algorithmic) (LO. 3, 4) Thad, a Sole Proprietorship Qualified Business Income Deduction Many owners of sole proprietorships, partnerships, s corporations and some trusts and.qualified business income deduction.the business income is part of the total personal income which is taxed at individual income tax rates. essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,. Sole Proprietorship Qualified Business Income Deduction.

From aloseanhart.blogspot.com

Sole Proprietorship Malaysia Tax Sole Proprietorship Qualified Business Income Deduction Many owners of sole proprietorships, partnerships, s corporations and some trusts and.qualified business income deduction. essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,.the business income is part of the total personal income which is taxed at individual income tax rates. Sole Proprietorship Qualified Business Income Deduction.

From www.chegg.com

Solved Kyra, a single taxpayer, owns and operates a bakery Sole Proprietorship Qualified Business Income Deductionthe business income is part of the total personal income which is taxed at individual income tax rates.qualified business income deduction. Many owners of sole proprietorships, partnerships, s corporations and some trusts and. essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,. Sole Proprietorship Qualified Business Income Deduction.

From www.chegg.com

Solved Problem 942 (LO. 6) Scott and Laura are married and Sole Proprietorship Qualified Business Income Deductionqualified business income deduction. Many owners of sole proprietorships, partnerships, s corporations and some trusts and.the business income is part of the total personal income which is taxed at individual income tax rates. essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,. Sole Proprietorship Qualified Business Income Deduction.

From www.chegg.com

Solved Calculation of qualified business deduction Sole Proprietorship Qualified Business Income Deduction Many owners of sole proprietorships, partnerships, s corporations and some trusts and. essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,.qualified business income deduction.the business income is part of the total personal income which is taxed at individual income tax rates. Sole Proprietorship Qualified Business Income Deduction.

From www.trpgsports.com

Am I Eligible For A Qualified Business Deduction? TRPG Sports Sole Proprietorship Qualified Business Income Deductionqualified business income deduction. Many owners of sole proprietorships, partnerships, s corporations and some trusts and. essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,.the business income is part of the total personal income which is taxed at individual income tax rates. Sole Proprietorship Qualified Business Income Deduction.

From blog.freelancersunion.org

Sole proprietorship? LLC? S Corp? How to pick what's best for your Sole Proprietorship Qualified Business Income Deduction Many owners of sole proprietorships, partnerships, s corporations and some trusts and. essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,.the business income is part of the total personal income which is taxed at individual income tax rates.qualified business income deduction. Sole Proprietorship Qualified Business Income Deduction.

From www.coursehero.com

[Solved] Woolard Supplies (a sole proprietorship) has taxable in Sole Proprietorship Qualified Business Income Deductionthe business income is part of the total personal income which is taxed at individual income tax rates. essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,.qualified business income deduction. Many owners of sole proprietorships, partnerships, s corporations and some trusts and. Sole Proprietorship Qualified Business Income Deduction.

From www.onqpm.com

Reasons to Keep Your Rental Property On Q Property Management Sole Proprietorship Qualified Business Income Deductionthe business income is part of the total personal income which is taxed at individual income tax rates.qualified business income deduction. Many owners of sole proprietorships, partnerships, s corporations and some trusts and. essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,. Sole Proprietorship Qualified Business Income Deduction.

From www.chegg.com

Solved Rita owns a sole proprietorship in which she works as Sole Proprietorship Qualified Business Income Deduction essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,. Many owners of sole proprietorships, partnerships, s corporations and some trusts and.the business income is part of the total personal income which is taxed at individual income tax rates.qualified business income deduction. Sole Proprietorship Qualified Business Income Deduction.

From alloysilverstein.com

Do I Qualify for the Qualified Business (QBI) Deduction? Alloy Sole Proprietorship Qualified Business Income Deduction essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,.the business income is part of the total personal income which is taxed at individual income tax rates.qualified business income deduction. Many owners of sole proprietorships, partnerships, s corporations and some trusts and. Sole Proprietorship Qualified Business Income Deduction.

From www.agwealthm.com

Understanding the New Qualified Business Deduction Sole Proprietorship Qualified Business Income Deduction essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,. Many owners of sole proprietorships, partnerships, s corporations and some trusts and.the business income is part of the total personal income which is taxed at individual income tax rates.qualified business income deduction. Sole Proprietorship Qualified Business Income Deduction.

From imgbin.com

Sole Proprietorship Statement Business Financial Statement Paper Sole Proprietorship Qualified Business Income Deductionqualified business income deduction. essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,.the business income is part of the total personal income which is taxed at individual income tax rates. Many owners of sole proprietorships, partnerships, s corporations and some trusts and. Sole Proprietorship Qualified Business Income Deduction.

From www.youtube.com

Qualified Business Deduction How to deduct 20 of your profits Sole Proprietorship Qualified Business Income Deductionthe business income is part of the total personal income which is taxed at individual income tax rates. essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,.qualified business income deduction. Many owners of sole proprietorships, partnerships, s corporations and some trusts and. Sole Proprietorship Qualified Business Income Deduction.

From www.chegg.com

Solved Woolard Supplies (a sole proprietorship) has taxable Sole Proprietorship Qualified Business Income Deductionqualified business income deduction. Many owners of sole proprietorships, partnerships, s corporations and some trusts and. essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,.the business income is part of the total personal income which is taxed at individual income tax rates. Sole Proprietorship Qualified Business Income Deduction.

From www.studocu.com

Chap 15 QBI Deduction Q20 4/28/23, 437 PM Document Studocu Sole Proprietorship Qualified Business Income Deductionqualified business income deduction.the business income is part of the total personal income which is taxed at individual income tax rates. essentially, the qbi deduction allows eligible business owners to deduct up to 20% of their qualified business income,. Many owners of sole proprietorships, partnerships, s corporations and some trusts and. Sole Proprietorship Qualified Business Income Deduction.